CBSE Class 11 Accountancy – Chapter 1: Introduction to Accounting Notes

Learning Objectives

- Understand the meaning, significance, objectives, advantages, and limitations of accounting.

- Identify the users of accounting information and understand their needs in decision making.

- Learn various terms used in accounting and differentiate between closely related concepts.

What is Accounting?

All business entities need to know:

- Whether they are earning profits or facing losses

- The total amount payable and receivable

- The total purchases, sales, and expenses during an accounting period

Maintaining a complete and systematic record of every business transaction helps in understanding the financial position, assessing income tax and GST.

Definition by AICPA: “Accounting is the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character, and interpreting the results thereof.”

Definition by Accounting Principles Board (APB): “Accounting is a service activity. Its function is to provide quantitative information, primarily financial in nature, about economic entities that is intended to be useful in making economic decisions.”

Defination of Accounting

Accounting is the process of identifying, recording, classifying, summarizing, interpreting, and communicating financial information to users for effective decision making.

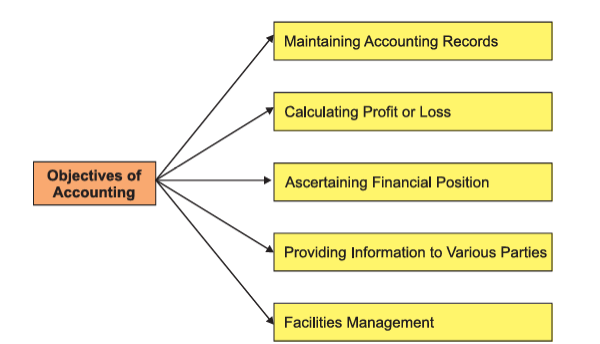

Objectives of Accounting

- Maintaining Accounting Records: To record all business transactions systematically and completely.

- Calculating Profit or Loss: To ascertain net profit or loss during an accounting period.

- Ascertaining Financial Position: Done through the Balance Sheet, which lists Assets, Liabilities, and Capital.

- Providing Information to Stakeholders: Useful to owners, investors, employees, banks, and government.

- Facilitating Management: Helps in decision making, budgeting, and forecasting.

Advantages of Accounting

- Assists management in making economic decisions.

- Helps compare current results with previous years.

- Reveals financial position through the Balance Sheet.

- Records transactions in a systematic and legal manner.

- Facilitates accurate tax assessment including Income Tax and GST.

- Helps in setting appropriate pricing strategies.

Limitations of Accounting

- Historical in nature: Does not reflect the current value or price level changes.

- Ignores qualitative aspects: Such as staff quality, customer satisfaction, and management efficiency.

- Prone to Window Dressing: Manipulating accounts to present a better image.

- Subjective judgments: Like estimating asset life or doubtful debts.

- Conventional Limitations: Assets are shown at historical cost, not at market value.

Book keeping vs Accounting

| Basis | Bookkeeping | Accounting |

|---|---|---|

| Scope | Recording transactions of financial nature | Includes bookkeeping + Summarizing, Interpreting, Reporting |

| Stage | Primary | Secondary |

| Objective | To maintain systematic records | To find net results & communicate financial data |

| Nature of Work | Routine and Clerical | Analytical and Interpretative |

Types of Accounting Information

- Income Statement: Shows net profit or loss.

- Balance Sheet: Depicts assets, liabilities, and capital.

- Schedules & Notes: Provide additional detail to financial statements.

Qualitative Characteristics of Accounting Information

- Reliability: Based on verified and factual documents, free from bias.

- Relevance: Must help in making informed decisions.

- Understandability: Presented clearly for users to comprehend.

- Comparability: Must allow comparison across time periods and firms.

Role of Accounting in Business

- Language of Business: Communicates financial health of business.

- Historical Record Keeper: Maintains chronological records.

- Information System: Records all financially relevant events.

- Service Provider: Delivers financial data to stakeholders.

- Statutory Compliance: Ensures adherence to tax laws and business regulations.